In February 2014, Yokohama Rubber signed a technical cooperation agreement with Korea's Kumho Tire. In June 2014, the two companies had just reached an agreement on the development of tire environmental protection technologies. However, Yokohama Rubber Co., Ltd.’s vision of Yoshihide’s future will be even more distant.

"It goes without saying that capital cooperation, if both sides feel favorable, the merger will be OK. I want to use the holding company's form, retaining the two brands is also an option."

Kumho’s sales are 60% of Yokohama Rubber. The company has experienced bankruptcy and is a company with a "spot". In view of this, this cooperation has not received much praise.

But Yokohama rubber does not mind. Two years ago, the company’s president, Nan Yun Zhongxin, met with Park San-keung, president of Kumho’s parent company Kumho Asiana Group. With the deepening of the exchange, Nanyun understood the technical strength of Kumho.

When Japan's time-honored companies and South Korean start-ups began to associate on the premise of "marriage", it was the day when two companies decided to part-way.

"What are they thinking?"

In the middle of the night of February 13, 2014, the company’s contact with the Sumitomo Rubber Industry was overshadowed by the company’s partner, Goodyear, which disclosed information submitted to the Securities and Exchange Commission on the Internet. In the data Goodyear wrote: "Because of the clear anti-competitive behavior of Sumitomo Rubber, we will terminate the partnership."

This has early warning. About 1 month ago, Goodyear proposed an application for cooperation, and Sumitomo Rubber had encountered a blow when it was ready to negotiate a friendly breakup. Sumitomo Rubber immediately submitted a rebuttal to the international arbitration agency.

In 1999, in the eyes of the envy of other companies, the two companies "happy hand" and spent 15 years of sweet time. However, the final outcome was a sad divorce drama.

Tough emerging markets strategy <br> <br> now, precarious global tire industry. The core of the oscillation is emerging market countries. According to Mizuho Bank’s forecast, in 2020, the world’s new car sales will expand to 98.61 million. Although markets in Japan, North America and Europe have stagnated, sales in emerging market countries will soar to 59.4 million vehicles, which is 1.5 times that in 2010. The growing middle class in China and India will play a leading role.

"In emerging market countries must first go ahead and strengthen" (Toyo Rubber Industry President Shin Mu-ming). In the face of the future “Golden Mountainâ€, major companies are coveted, but for now, no one company has successfully overcome the new market.

Tires are divided into new car tires that are sold to auto companies for wholesale, and replacement tires that are retailed at tire sales stores, gas stations, and so on. In developed countries, the ratio of the two is 6:4, and the sales of new car tires are mostly, while in emerging market countries where the used car circulation is huge, it is better to replace the tires. The demand for global tires in 2020 is 2.1 billion, of which only 450 million are new car tires. The replacement of tires is 1.66 billion, which is more than three times that of the former.

Therefore, emerging market countries cannot apply developed country strategies that focus on auto companies. Because most consumers do not look at the brand when they choose to replace tires, Bridgestone, France's Michelin, and Goodyear's Big Three share only 1-3% in the Chinese market.

Faced with this situation, big companies certainly will not sit still. To increase sales of replacement tires, retail outlets must give priority to their own tire products.

To this end, Bridgestone has opened more than 300 "Wing Wing" chain stores in China. These stores not only sell tires. The brand will also be promoted through independent customer services such as providing free periodic inspections.

Outside the scope of cooperation friction fire <br> <br> On the other hand, Sumitomo Rubber chain stores in China from the current 570 in 2015. 1000. There are also more than 650 chain stores in India.

The original cooperation between Sumitomo Rubber and Goodyear was based on Goodluck's production and sales of Sumitomo Rubber's main brand, DUNLOP, in North America and Europe. Sumitomo Rubber also sold the "Goodyear" brand in Japan. Therefore, "Since 10 years ago, Sumitomo Rubber has placed its development focus outside North America and Europe in order to avoid smashing the market with Goodyear."

However, ironically, some good intentions turned into a kind of friction. In emerging market countries outside the framework of cooperation, Sumitomo Rubber's "Dunlop" and Goodyear's competition are getting more and more, and the relationship between them has begun to become tense.

Senior Matsumoto Bongyu, senior analyst at SMBC Nikko Securities, calculated that the loss of the cooperation to Sumitomo Rubber was equivalent to sales of 50 to 60 billion yen and operating profits of 13.0 billion yen. Although the impact is not small, Matsumoto pointed out that "if we continue to expand the business of emerging market countries according to the current momentum, we can recover the losses within 3 to 5 years." In Matsumoto's view, if we look at the medium and long term, the lifting of cooperation will help to strengthen the business foundation of Sumitomo Rubber.

After opening ground warfare through the addition of shops, there are companies that boldly launched air battles. In May 2014, Serie A staged the Milan Derby. In the television broadcast, the blue "TOYOTIRES" LOGO appeared in the prominent position of the stadium.

Toyo Rubber signed an agreement with AC Milan where Honda Keisuke is located, becoming the team's first senior sponsor from Japan. At first glance, this seems to be an advertising strategy for the Japanese and European markets, but the company's idea is not so simple. "This is in fact meant to start Russia playing before Honda, as well as Asia and the Middle East who are concerned about European football" (the company).

Emerging market countries take aim not just big business <br> <br> front tire sales in 2012 of twenty among emerging enterprises won ten seats, accounting for half. During this decade, although the Big Three's sales have grown steadily, the total share has decreased by 17%. The momentum of emerging companies is evident.

In addition to representatives of emerging companies and Kumho, which cooperates with Yokohama Rubber, Korean companies such as Hankook and Nexans have also emerged. Accompanied by the growth of Hyundai Motor Co., which has already become a global manufacturer, these companies have expanded their business scale and their trajectory is exactly the same as that of Japanese companies.

Until recently, the tires of emerging companies were mostly low-priced products, and it appeared to the auto companies in developed countries that there were no enough teeth.

However, the current situation is no longer comparable. Leading companies such as Toyota, Germany's Daimler, and BMW have adopted new products for new vehicles in succession. Passenger car tires of the emerging companies that are in the forefront of their identities are “not much different in quality from Japanese companies†(Nissan Motors).

But prices are 10 to 20% cheaper than big companies. The leap of a new company is entirely reasonable.

On the other hand, the dynamics of serpentine images have also emerged. Ranked 17th in the world by the tire industry, Apollo Tire India announced in 2013 that it would spend 240 billion yen to acquire the No. 11 US Cooper tire division. Although in the end the two parties did not reach an agreement on the amount, the negotiations eventually broke down. However, if this acquisition becomes a reality, a new company with a business scale comparable to the sixth ranked Italian Pirelli will be born in India.

However, as of now, emerging companies have only entered part of the passenger car tires. The special tire business that requires superior technical strength is still the world of big companies.

Bridgestone and Michelin have more than 80% share of ultra-large construction and mining tires is a typical example.

Large dimensions and margins are very large level <br> <br> tire hub diameter of 51 to 63 inches and the total height is approximately twice the height of adults. The unit price of one tire is as high as several million yen, and the profit rate is estimated to be about 20%, which is much higher than that of passenger cars.

The Bridgestone Saga factory is located in the corner of an industrial park in Kami-cho, Saga Prefecture. With the booming roar, thousands of machines are not producing tires. It is the structural material of the tire - a steel cord with a diameter of 0.2-0.5 mm.

The Saga Plant produces special steel cords for super-sized tires. Special vehicles traveling in mining areas need to drive on rough roads and tires are easily damaged. By bringing together about 200 special steel cords into one bundle, the inside of the rubber can make the tires strong enough to cope with the harsh environment.

Now, the autonomous technology of special steel cords has become the source of Bridgestone's competitiveness. Moreover, with the help of internal production, the company has also established a system that can directly reflect the driving data of mining and working sites to the development and production processes (the director Tamura Yasuyuki), successfully accelerating the speed of product improvement.

Not just technology. In 2012, Bridgestone also developed a system that utilizes tire chips to inspect tire pressure and temperature changes in building and mining vehicle tires and informs drivers. If you can detect in advance that the tire may be broken and avoid it in time, you can extend the use of the tire. Although this may lead to a temporary decline in sales, the company puts the trust of customers and maintains its share in the first place.

This is also true of Toyo Rubber's popular SUV (multifunctional sports car) large tires in North America. Patterns on the surface of the tire can only be made using the company's own method. The process is like playing a beautiful ribbon, and other companies can't simply follow suit.

EV exacerbate tire restructuring <br> <br> dating back some 30 years ago, a storm had swept through the reorganization of the tire industry. Bridgestone acquired the top US Firestone, and Sumitomo Rubber acquired the original parent company, Dunlop's European tire business. There is only one purpose of successive M & A (mergers and acquisitions), that is, the pursuit of "scale efficiency" in order to achieve stable returns. After the merger and acquisition, more than 30 tire companies at the time left only about 10 large companies.

Now, large companies already have a certain scale of business, and the possibility of reorganization is low. On the other hand, emerging companies are now at a stage where they are trying to increase their scale.

Is it an independent route? Collaborate with other companies? Is it still a merger or acquisition of large companies? Emerging companies will undoubtedly become the decisive factor in the future restructuring of the industry.

The EV (Pure Electric Vehicle), which is expected to spread in the future, will also speed up the reorganization of the tire industry. Compared to gasoline vehicles, the EV spins faster at the initial speed. And you must leave space for the battery. In view of the above characteristics, EVs are required to have a tire with a high abrasion resistance and a narrow width.

As long as new concept tyres for the new generation of cars can be manufactured, even emerging companies can shake the fortress of the Big Three.

"Even if a car can fly in the sky, it needs a tire when it lands." This is an old saying in the tire industry, but this does not mean that tire companies can survive without doing anything.

The shapes and functions of the tires that the car needs in the future may be different from those in the past. Only tire companies that respond to changes in tire demand and respond quickly can beat the “second reorganization stormâ€.

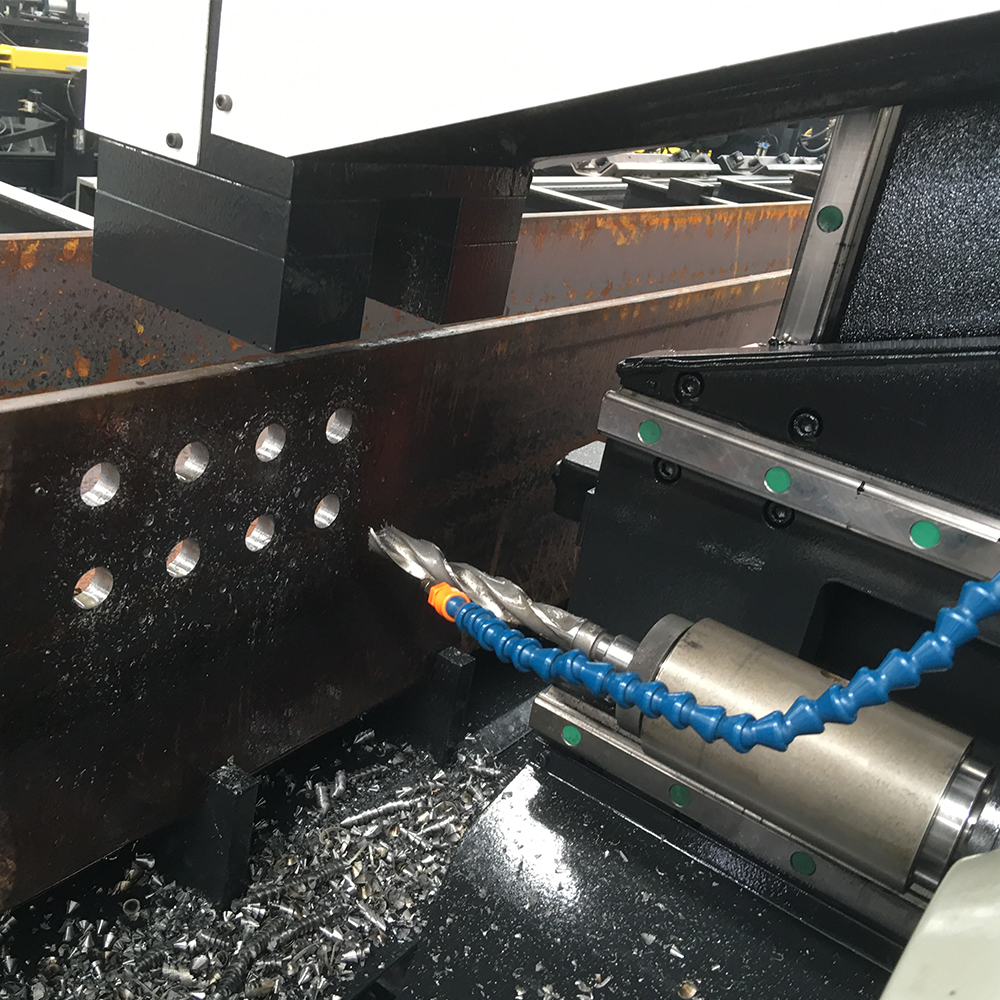

Single Spindle H Beam Drilling Machine

Applicable industry:

Used for the drilling processing of H-shape steel, box beam, angle steel and channel steel of steel structure,

bridge, three dimensional garage and petrol platform.

Product feature:

1. PLC systems, LCD screen display, programming Microsoft based on WINDOWS platform, fast and convenient programming, and visual previewing.

2. Main machine, hydraulic pressure, electric components are famous products domestic and abroad.

3.Equipped with automatic feeding system, which will clamp and feeding material into machine automatically.

4. Double linear guides` infeeding, precision much higher and more stable.

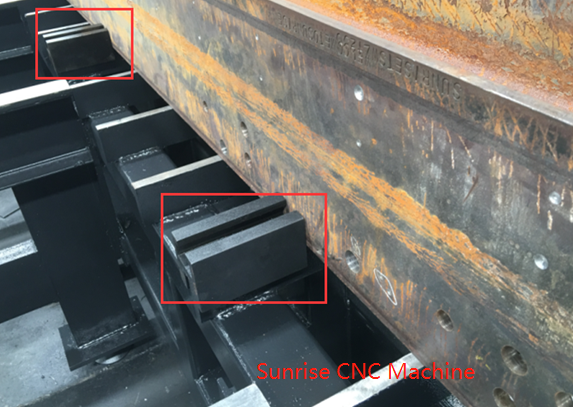

The Pressure Blocks

Hydraulic clamps

The pressure blocks with high pressure force, make sure with the tooling together fixed the workpiece tightly. Operation is very easy.

FAQ

Q: Are you trading company or manufacturer ?

A: We are professional manufactutrer, have in this line about 10 years.

Q: How long is your delivery time?

A: Generally it is 5-10 days if the goods are in stock. or it is 30-50 days if the goods are not in stock.

Q: What is your terms of payment ?

A: Payment 30% T/T in advance ,70%balance before shippment

Steel Drilling Machine,Punching Drilling Machine,CNC Steel Drilling Machine,Steel Plate Drilling Machine

Shandong Sunrise CNC Machine Co., Ltd , http://www.scmcnc.com